Since the Herald began a series over the weekend looking at the global depression, I figured I’d start posting a few pointed historical facts and figures here – including a few parallels.

According to Austrian economists like Peter Schiff, Mark Thornton and Thorstein Polleit – who all draw their theoretical powder from Ludwig von Mises’ theory of the business cycle, which allowed him to see the oncoming Great Depression -- the seeds of destruction in both the thirties depression and the present model occurred in the years before their respective bubbles exploded.

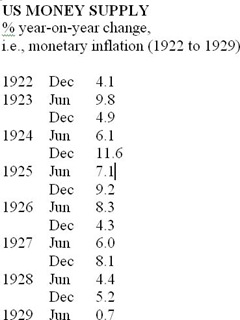

In both cases, ‘the Fed’ pumped up the money supply, which spilled over in the twenties into the stock market, and in the 2000s into the housing market. These were the most obvious of the many malinvestments caused by the dramatic monetary inflation, a phenomena that both Keynesian and Friedmanite economists largely ignore. These are the figures which blew up the bubble; the inflationary figures they have no time for:

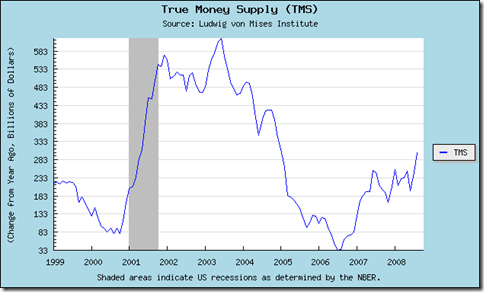

Compare that to the increases over the 2000s (graph pinched from Bob Murphy’s fine article ‘Evidence that the Fed Caused the Housing Boom’), which reflects too the post-bust frenzy in which the central bankers are still printing like mad.:

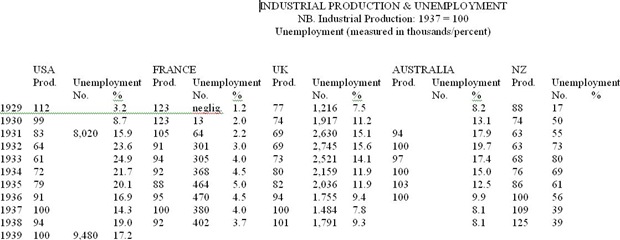

Now, note that both depressions started in the States (the thirties depression, albeit, as a result of European attempts to avoid paying for the First World War), but as the figures below will indicate, the effect of the global depression was different in every country. It was deep and it was long everywhere, but as it happens, it was deeper and lasted longer in those countries like the US who adopted the most profligate solutions (i.e., all the big-spending solutions favoured today) and who insisted on keeping wages and prices high so as to maintain ‘demand,’ and less so in those countries that weren’t so profligate, and who allowed wages and prices to fall to reflect the new realities. (Note that the Scandinavians had another reason for their apparent immunity – they were supplying Hitler’s war economy, a bill that would be submitted to the world in the next decade).

The depth and distress can be seen by comparing year-on-year figures for major countries (and by including our own wee corner of paradise). As you can see, there’s still a few gaps to fill in …

The world was just as globalised then –- at least it was before the passage of the US’s Smoot Hawley Tariff Disaster. It was just as much prey to central bank meddling with the money supply. And in both decades they the monetary inflation led to a credit bubble that popped.

Perhaps the biggest difference now is that more countries’ governments, including NZ’s, were prepared to let the ‘sharp edges’ of the world depression be taken off by the ‘classical’ solution of letting wages and prices fall, instead of trying to keep them up by profligacy.

And in the context of employment, there is now another another big difference between then and now: the number of people now directly employed by the state – which is to say, carried on the shoulders of the productive – is vastly more than it was back then. And as Forbes magazine reminds us, there is no depression for the state.

UPDATE: On a related note, Austrian economist David Gordon says,

In the present recession, advocates of government intervention often evoke the specter of the Great Depression. Unless the government intervenes massively, we are told, we risk an economic collapse comparable to that of the 1930s. To see the fallacy of this claim, it is imperative to understand that government intervention both led to the Depression and prevented recovery from it. The following books, I hope, will assist those interested in grasping what happened in this vital historical era.

Read on here: What You Must Read About the Great Depression.

1 comment:

I am going to carry littles cards on which is printed your table "INDUSTRIAL PROCUCTION & UNEMPLOYMENT". Whenever someone says "stimulation is necessary" I shall hand them a card.

Post a Comment