Guest post by Hugh Pavletich

The recent Forbes e-edition article by Jesse Colombo assessing the New Zealand economy, “12 Reasons Why New Zealand's Economic Bubble Will End In Disaster” (about which we blogged here yesterday) seems to have created quite a stir, creating extensive media coverage in New Zealand.

One article alone, Michael Field’s major Fairfax article ‘NZ bubble 'going to burst', stimulated a remarkable 500+ comments.

It didn’t take too long for the politicians to react, with Acting Finance Minister Steven Joyce downplaying it, unhelpfully personally attacking Mr Colombo, with Labour’s David Cunliffe and David Parker largely agreeing with Mr Colombo’s assessment.

But then, they would all say that, wouldn’t they.

Mr Colombo’s initial assessment (a comprehensive report is to follow) was from a financial expert’s perspective, and rested largely on New Zealand’s level and fragility of mortage debt, and local banks’ exposure to it.

Let’s consider, looking specifically at housing affordability, whether Mr Colombo is correct from a structural perspective.

January every year the Annual Demographia International Housing Affordability Survey is released, with the 10th Annual Edition released 20 January this year.

Normal (and therefore affordable) housing markets do note exceed annual household income (Median Multiple), requiring mortgage loads of about 2.5 times. Currently, most major New Zealand metropolitan housing markets are well north of this – Auckland, Wellington and Christchurch (even pre-earthquake) recording an income-to-house-price ratio of either over or nearly over 6.0!

A clear structural definition of an affordable housing market is …

For metropolitan areas to rate as 'affordable' and ensure that housing bubbles are not triggered, housing prices should not exceed three times gross annual household earnings. To allow this to occur, new starter housing of an acceptable quality to the purchasers, with associated commercial and industrial development, must be allowed to be provided on the urban fringes at 2.5 times the gross annual median household income of that urban market (refer Demographia Survey Schedules for guidance).

The critically important Development Ratios for this new fringe starter housing, should be 17 - 23% serviced lot / section cost - the balance the actual housing construction.

Ideally through a normal building cycle, the Median Multiple should move from a Floor Multiple of 2.3, through a Swing Multiple of 2.5 to a Ceiling Multiple of 2.7 - to ensure maximum stability and optimal medium and long term performance of the residential construction sector.

New Zealand is far from that. Yet, since the creation of the US housing production industry by Bill and Alfred Levitt following World War 2, when new starter suburban housing was put in place for about $US100 per square metre all up (serviced section and house construction … 80 square metre units on 700 square metre lots for $US8,000), there has been no mystery about how to supply affordable housing (other than for politicians and bureaucrats who find truth “inconvenient”).

What is required to restore housing affordability in New Zealand is outlined within Section 4 of my earlier post “Christchurch: The Way Forward.” It is simply about ALLOWING affordable land to be supplied, and financing infrastructure properly.

Australian Federal Senator-Elect Bob Day (before his election, a major Australian production house-builder and former President of the Housing Industry Association of Australia) recently explained the issue most eloquently, within a video interview with Business Spectator: Read Bob Day on affordable housing and jobs for young people ... Business Spectator .

The simple fact is, that we’re just not building enough. And it’s not just us. As explained recently within “China: Big Bubble Trouble”, even in pre-war London, new starter semi-detached housing was being supplied for slightly over 2.0 times annual household incomes. The reason: They were building way more new housing on a population basis in the United Kingdom even through the Depression years than they are today.

Through these eras too, it was normal for households to have just one income earner, as the male was seen as a “loser” if he was unable to financially provide for his family. The social pressures were quite significant.

As eminent Hoover Institution economist Thomas Sowell said “We have spent the past few decades replacing what works with what feels good”. In a 2009 interview (video) Mr Sowell described the causes of the 2007 Global Financial Crisis. See: Thomas Sowell on the Housing Boom and Bust - YouTube .

During early 2009, your present writer explained why economists have such a poor understanding of housing bubbles with . Most wouldn’t know a house market from a horse market internationally … although thankfully … Australian and New Zealand economists are sometimes now better informed. Importantly, many have been constructive contributors to politically progressing this serious issue.

So what did this year’s Demographia Survey (data 3rd Qtr 2013) find with respect to New Zealand’s major urban markets ?

Median Auckland housing priced at 8.0 times annual median household incomes; Tauranga 6.6; Christchurch near 6.0; Wellington 5.5; Napier-Hastings 5.4; Dunedin 5.2; Hamilton 4.8 and Palmerston North 4.5.

Not pretty.

Another useful measure of housing affordability is the relationship between Total Housing Stock Value and Gross Domestic / State / Metropolitan Product, which should not exceed at tops 1.5 times … ideally no more than 1.2 times.

September last year James Gruber writing for Forbes “3 Warning Signs Of A Bloodbath Ahead” , incorporated a graph (requires updating) illustrating the ratios of Total Housing Stock Value to GDP for Australia, New Zealand, the United Kingdom, Canada and the United States …

Not surprisingly, the result mirrors the Demographia Survey.

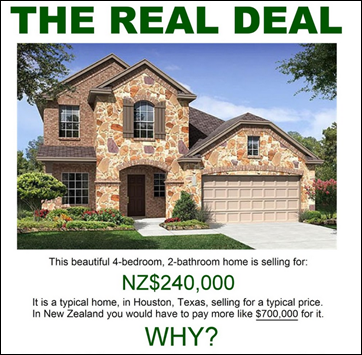

As a further check, Greater Houston with its population of about 6.1 million has a Gross Metropolitan Product of near $500 billion (in contrast to New Zealand with a population of 4.5 million and a GDP PPP of about a paltry $US140 billion … some $NZ210 billion ).

In relative terms, this is due to a history of poor quality public policy and a seriously degenerate public service culture at central and local level (a further recent example of gross incompetence … Error Prone Bureaucracy ). Little wonder then, that while New Zealanders had the highest GDP per capita in the world in 1920 (refer Angus Maddison Historical GDP Per Capita Tables ), but today it ranks about 46 ... between Italy and Slovenia ..

Because of its degenerate public service, not surprisingly, New Zealand also has the worst traffic congestion problems in the developed world too. (Read ‘New Zealand Has Worst Traffic: International Data’ by Wendell Cox | Newgeography.com

Rather amusingly, at current exchange rates in $US terms, New Zealand’s generally poor quality housing stock is “worth” more than the entire housing stock of Greater Houston !

New Zealand is a country that has been bureaucratically buggered. A textbook case of “institutional failure” at central and local level. The “rock-star” label is clearly nonsense.

New Zealand’s current economic activity is being “juiced up” due to a China Bubble Boom and the excessive costs of the Christchurch earthquake recovery. Bureaucratic incompetence has meant this painfully long recovery will be a $NZ40 billion exercise, when it should have been in the order of $NZ15 billion.

The latest figures from the Reserve Bank of New Zealand indicate the New Zealand housing stock has a “value” of some $NZ716 billion … roughly 3.4 times its GDP. It should not exceed 1.5 times ($NZ315 billion … ideally 1.2 times ($NZ252 billion). This suggests there is something in the order of $NZ401 and $NZ461 billions of bubble value in New Zealand housing. It takes about 25% of mortgages incorporated within this bubble value to fuel it … some$NZ100 billion through $NZ115 billion of at risk bubble mortgage value.

The problem is the New Zealand Banks only have a capital base of about $NZ29 billion (RBNZ figures).

Currently, the major international concern is China … and its transitioning from a panicked and manic investment frenzy following the 2007 Global Financial Crisis (triggered by the North American urban planners … no doubt the Chinese Communists are not grateful). China is slowing, as explained within a recent Financial Times article Do Chinas Qtr1 GDP Numbers Gloss Reality? .

Information from the Chinese National Statistics Bureau illustrate the extent of the massive residential overbuilding and abrupt falloff in sales and new construction so far this year …

In the first three months, the floor space under construction by the real estate development enterprises accounted for 5,470.30 million square meters, up by 14.2 percent year-on-year, decreased 2.1 percentage points over the first two months. Of which, the floor space of residential building construction area was 3,932.06 million square meters, up by 11.4 percent.

The floor space started this year was 290.90 millions square meters, down by 25.2 percent, and the pace of decline narrowed 2.2 percentage points. Specifically, the floor space of residential buildings started in the year amounted to 212.38 million square meters, down by 27.2 percent.

The floor space of buildings completed stood at 185.20 million square meters, went down by 4.9 percent, and the pace of decline narrowed 3.3 percentage points, of which, the floor space completed of residential buildings stood at 139.10 million square meters, went down by 7.3 percent.

Does it say 'it has bottomed out'? Is this a soft landing? -25%?

At say 60 to 80 square metres each (plus common area), in number of unit terms, how many of these apartments have been put in place in China over recent years ? What is the build rate per 1,000 population per annum for the Chinese metros ?

It would appear China could be described as Ireland by 300 … or even 500 times … with much greater “multiple stretch” in the former. And that’s without considering the commercial and infrastructure over-spend and mal-investment.

The Irish bubble collapsed at much lower Median Multiples than those currently prevailing in China, New Zealand and Australia.

Ireland is no doubt an excellent “case study” for Australian and New Zealand policy makers, as they are assessing the consequences of the bubbles collapsing in their own countries. They will be well aware that there has been no sustainable bubble in history.

Mr Colombo assessed the New Zealand economy from a financial perspective. This brief “structural check” indicates Mr Colombo is correct.

Hugh Pavletich is a Christchurch entrepreneur, the owner of website Performance Urban Planning and the co-author of the Annual Demographia International Housing Affordability Survey.

This post first appeared at Scoop.

EXECUTIVE SUMMARY

The only inflation concern for the Reserve Bank recently has been house price inflation, with consumer price and labour cost inflation low, but this will change over the next couple of years. Labour cost inflation, that is central to medium-term consumer price inflation prospects, will become a problem despite the Reserve Bank's benign forecasts. Rising labour cost inflation will play an important part in justifying sufficient OCR hikes over the next couple of years to put the housing market under significant stress. Unfortunately, the Reserve Bank doesn't have a particularly good forecasting track record on either front (i.e. house prices or labour cost inflation)….

6 comments:

Bank deposits are regarded as unsecured creditors. Finance companies last time this time the trading banks. Bank deposits will be used to bail out the NZ banking system. This is a RBNZ policy. Diversify or move money offshore.

I have a longstanding habit dating back to 1997 of having no more than $200 in any bank account, company and personal, with the rest of the money withdrawn in cash each morning and placed in safe deposit boxes.

I don't trust those slimy buggers at Westpac any further than I could throw them! haha!

Although most people I know find this activity a little odd and perhaps a sign of my Jewish heritage, I recommend it to everybody; if things go tits up it won't be me left with no 'readies' to live on or operate my companies with.

if things go tits up it won't be me left with no 'readies' to live on

Until the government changes the design of the currency overnight and all your 'readies' are worth nothing.

Ireland did this in the 1990s; NZ could do it anytime.

You guys are hilarious. Simon's moving his assets (a gummy bear collection) to Paraguay to avoid the coming apocalypse (the banks are failing!!!!!). Lineberry keeps all his money for operating his "companies" in cash because it's safer than a bank (your $3.50 might get lost though!). Angry Tory bursts his bubble with something he simply made up. Are you all like this?

Tory - I would simply exchange them for new ones as everyone did in the run up to decimal currency; the money is 'legit' so what would the problem be?

I would prefer it, Angry Tory, if you didn't go around implying I am up to any 'funny business' dear boy - I simply don't like banks.

There is no requirement to keep money in bank accounts, just because the sheeple do it doesn't mean I have to join in; everyone I deal with much prefers to be paid in cash and often comment how they wished everybody was like me.

Thank you for sharing valuable information. Nice post. I enjoyed reading this post. The whole blog is very nice found some good stuff and good information here Thanks..Also visit my page. rental property tax Intouch Accountants aims to provide an affordable, timely, clear and concise accounting service for small and medium businesses.

Post a Comment